Close Loans Faster Without Adding Overhead

From loan origination to servicing, our platform integrates seamlessly into your workflows —turning hours of admin into minutes.

AI-Assisted Borrower Qualification

Manual borrower qualification takes time. Our AI-assistant collects borrower information, runs checks, and inputs data directly into your system—all aligned with your guidelines. Focus on deals, not data entry.

Support For Every Role

Our AI-assistants handle routine tasks like lead qualification, borrower updates, document verification, and collections—freeing up loan officers and processors to focus on strategic work. It’s like adding a new team member, without the overhead.

Improved Borrower Experience

Keep your borrowers informed throughout the loan process with automatic status updates. From document submission reminders to loan approval notifications, our platform ensures timely communication, reducing unnecessary inbound calls and improving borrower satisfaction.

Our All-In-One Platform

Loan Officer Assistant

Let the AI assistant handle routine borrower calls, responding to inquiries about loan status and document needs. This reduces your team’s workload while ensuring seamless communication with borrowers.

Account Executive Assistant

Monitor the status of every loan opportunity from start to finish. With real-time updates and conversation tracking, your team can manage their pipeline more effectively and close deals faster.

Setup Assistant

Automates the setup process, from gathering required documents to initializing workflows, reducing errors and speeding up the loan’s progress from day one.

FileFlow™

Upload borrower documents and verify them against the loan application. It simplifies the verification process, ensuring accuracy and compliance while keeping loans on track.

Collections Assistant

Handles borrower outreach, payment reminders, and overdue follow-ups, so your collections process is efficient, ensuring consistent cash-flow.

Customer Service Assistant

Provides real-time updates, answers common questions, and ensures borrowers stay informed and supported throughout the loan process.

Integrations

We work with the tools you already use.

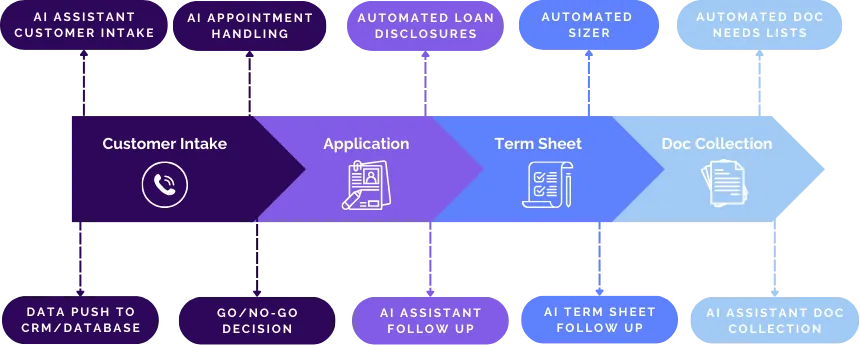

Loan Origination

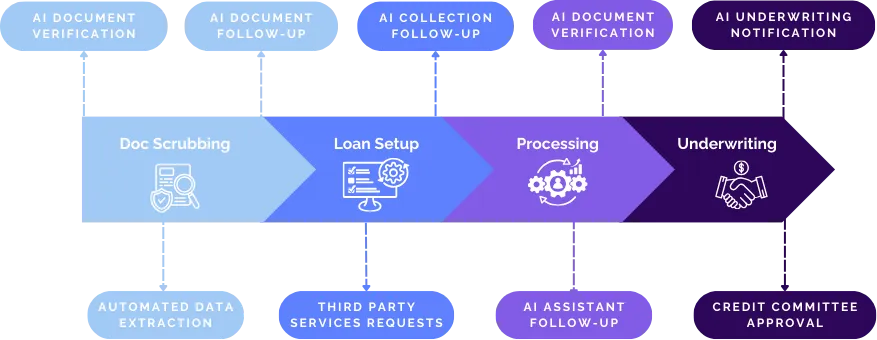

Loan Processing

Pricing Plans

Flexible pricing to help you scale your lending operations

(click below to see full details)

Streamline lead qualification and borrower communication to help loan officers focus on closing deals faster.

Track milestones, manage client updates, and keep deals moving efficiently through the pipeline.

Automate loan setup and document collection to ensure every deal starts on the right track.

Ensure consistent cash flow with automated payment reminders, overdue follow-ups, and borrower outreach.

Enhance borrower satisfaction by providing real-time updates and support without overloading your team.

Ensures every loan file meets the necessary requirements, saving your team time and reducing the risk of errors or delays.

Prices listed are our base prices for each assistant and are subject to change depending on the level of integration.

Connect With Us

Want to see more?

Book a demo!

Want to learn more about how our platform can help you streamline your lending process and boost efficiency? Get in touch today to schedule a demo or discuss how we can tailor a solution to fit your needs.

Why RTL Tech?

We understand the complexities of the lending process and designed our platform to simplify every step—from pre-qualification to closing. With automation that saves time and reduces costs, customizable solutions to fit your workflow, and tools that enhance borrower communication, we help you focus on what matters most: closing more loans and growing your business.

Partner with us to stay ahead in a competitive market while boosting your team’s efficiency and profitability.

RTL Tech's AI has transformed our operations. The AI handles our prescreening, follow-ups, and outbound calls. This really increased the volume of our qualified leads and reduced our operating costs. It’s become a part of our growth strategy, and we’re thrilled with the results!

Jessica, Direct Lender

RTL Tech has been a game-changer for our lending business. Their AI assistants have saved us time, cut overhead costs and improved our our conversion rates. The integration with our systems has allowed our team to focus on closing more deals. Highly recommend this service/

John, Broker @ Red Dirt Cap Fund

© Copyright 2024 All rights reserved